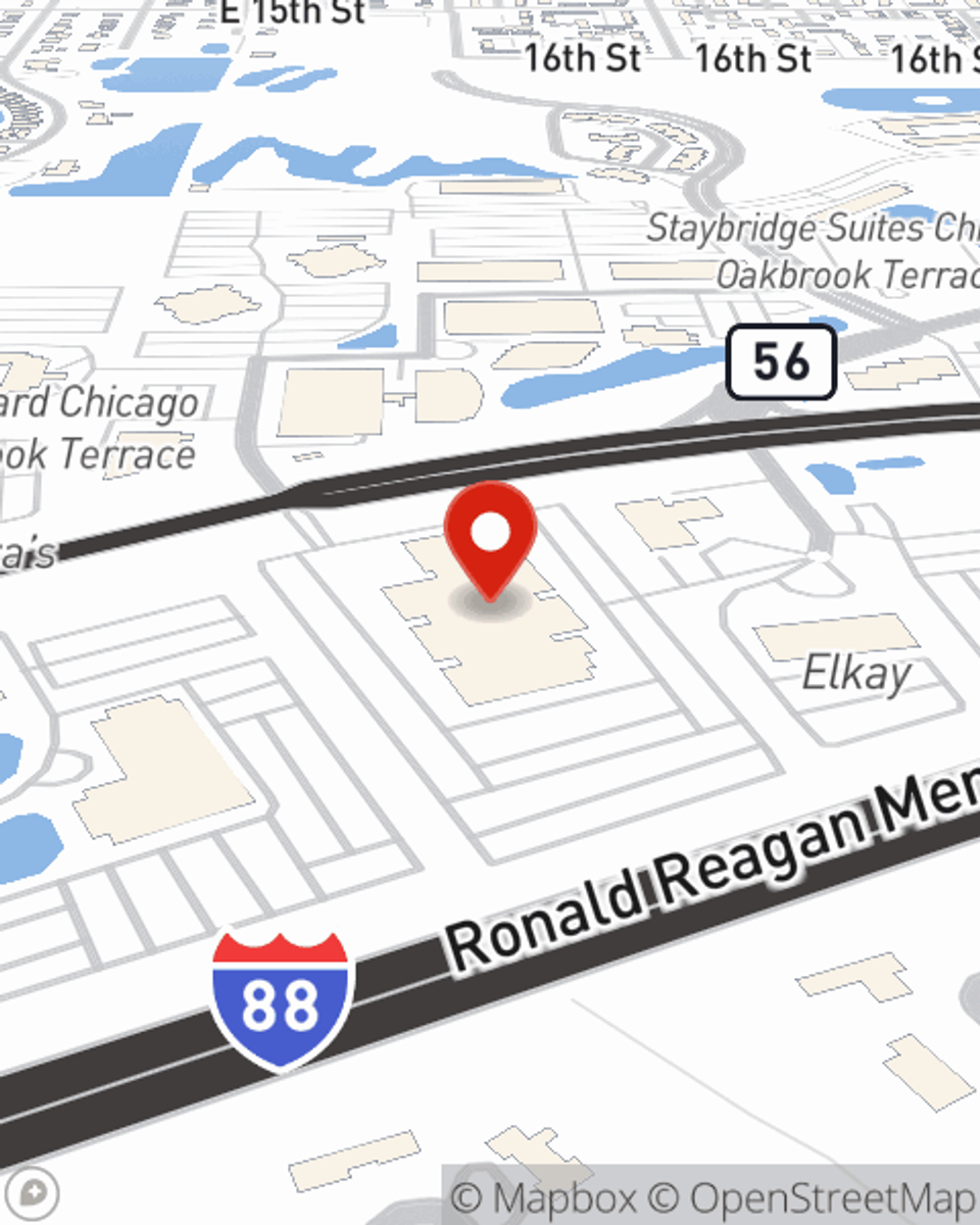

Insurance in and around Oak Brook

A variety of coverage options to help meet your needs

Insurance that works for you

Would you like to create a personalized quote?

Be Ready For The Unexpected With Your Own Personal Price Plan®

We can help you create a Personal Price Plan® to help protect what’s important to you – family, things and your bottom line. From safe driving rewards, bundling options and discounts*, build your coverage to meet your distinct needs. Contact Bill Hepburn for a Personalized Price Plan.

A variety of coverage options to help meet your needs

Insurance that works for you

We’re There When You Need Us Most

But your automobile is just one of the many insurance products where State Farm and Bill Hepburn can help. House, condo, or apartment, if it’s your home, it deserves State Farm protection. And for the unexpected. Securing your family’s financial future can be a major concern. Let us ease that burden. With a range of products, cost structures, and unmatched financial strength, State Farm Life Insurance is a smart choice and a great value.

Simple Insights®

Safety tips for food spoilage

Safety tips for food spoilage

Whether you’re experiencing a power outage or left some food out for a while, here are some safety tips to help avoid consuming spoiled food.

Bill Hepburn

State Farm® Insurance AgentSimple Insights®

Safety tips for food spoilage

Safety tips for food spoilage

Whether you’re experiencing a power outage or left some food out for a while, here are some safety tips to help avoid consuming spoiled food.